Cost-Delay-Quality Decision Scenarios

Key role(s)

Objectives

Benefits

This is a major objective of a global FinOps approach, helping to achieve the right trade-off between the 3 dimensions: Cost, Speed, Quality.

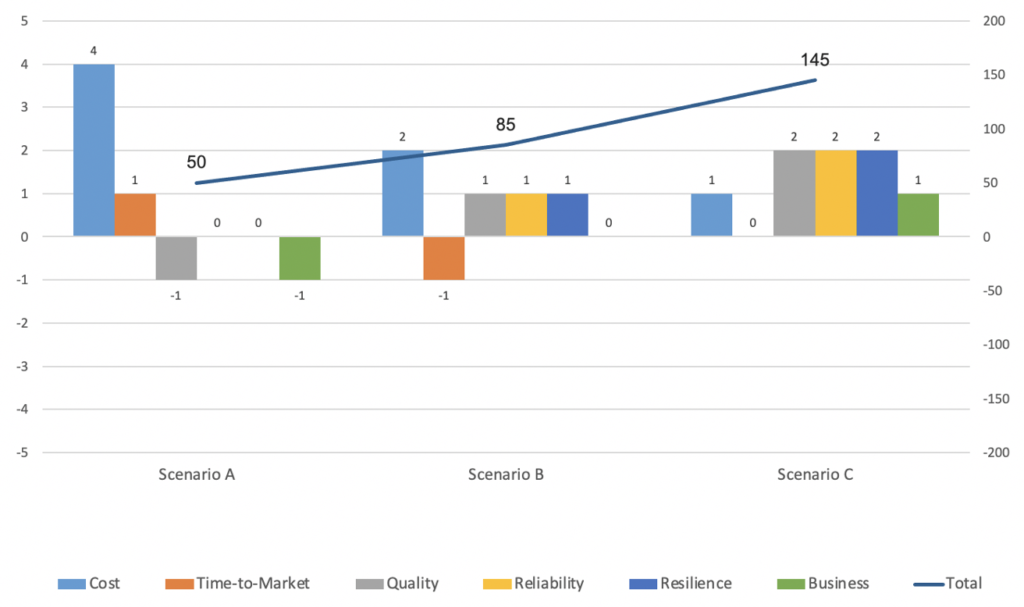

To be able to make the right choices, it may be useful to set up a scoring of optimization opportunities based on weighted impacts including :

- Costs

- Time-to-Market

- Quality

- Reliability

- Resilience

- Business impact

Let's take an example with 3 scenarios:

| IMPACTS | POIDS | SC. 1 | SC. 2 | SC. 3 |

| Coûts | 20 | 4 | 2 | 1 |

| Time-to-Market | 10 | 1 | -1 | 0 |

| Qualité | 25 | -1 | 1 | 2 |

| Fiabilité | 20 | 0 | 1 | 2 |

| Résilience | 10 | 0 | 1 | 2 |

| Business | 15 | -1 | 0 | 1 |

| TOTAL | 100 | 50 | 85 | 145 |

By comparing each score for each dimension we can see for example that scenario A represents the best impact on costs and time-to-market.

But by calculating the weighted scores we realize that, in our specific case, scenario C is the best, in terms of total score but also because it has only positive or neutral impacts.

With a representation of this type, one can compare for each dimension but also the total. It is also a demonstration that one must remain vigilant in the way information is presented, in order to be able to make the right choices adapted to the company.